The Of Financing Bad Credit

A cash advance loan provider will not always perform a credit contact the major credit report bureaus when you get a finance. financing bad credit. While that might make it much easier to obtain a payday financing when you have bad credit rating, the high expense can make it tough to pay back. High-cost payday loaning is prohibited in some states.

If you're denied credit score because of details in your credit rating reports, you need to receive what's called an unfavorable action notice from the loan provider, offering you a description. This can help you comprehend why you were rejected as well as motivate you to brush through your credit report records and see where your credit report stands.

6 Easy Facts About Financing Bad Credit Described

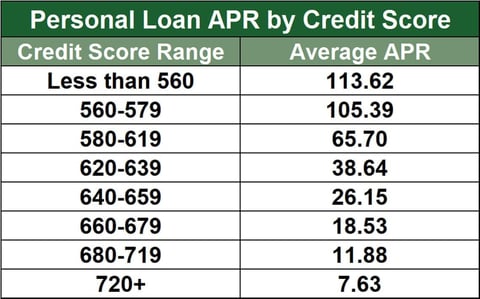

Below are a few lending kinds to take into consideration if you have bad debt. Some individual funding lenders provide installment car loans to individuals with poor credit rating. If you qualify, you'll likely pay greater interest rates than a person with good credit scores however it'll probably still be much less than you 'd pay with a cash advance.

A common payday advance may have an APR of 400%, and also the brief repayment timeline usually catches customers in a cycle of financial debt that's hard to run away. When we searched for the very best personal fundings for bad credit rating we took into consideration aspects such as simplicity of the lending application procedure, interest prices, charges, financing amounts offered, lending terms and also lender transparency.

If this seems like something you would certainly be interested in discovering even more regarding, after that take a moment to read our testimonial of the most effective installation lendings for poor debt. Low credit rating candidates accepted Money in as little as 24-hour Huge network of lenders Registered OLA participant Quality choice of academic sources $5,000 max car loan quantity Not readily available in all states Developed in 2010, Cash, Mutual is an online financing market that focuses on installment fundings, individual finances, as well as brief term cash loan.

The Of Financing Bad Credit

To use the service, merely complete an application, enter the desired lending quantity, as well as let Money, Common work its magic. In many cases, Money, Mutual can have a finance authorized and money in your account in as low as 24 hours. What's even more, the company deals with a number of loan providers going to approve unsafe individual car loans for applicants with a credit rating of 600 or much less.

Moreover, the business is an approved participant of the Online Lenders Partnership - an organization devoted to protecting consumers and also laying out standards and best practices for on-line lenders. To utilize Cash, Mutual, applicants must have a minimal regular monthly earnings of $800 and be 18 years old or older. Some loan providers in the network even approve social protection, special needs, and also other kinds of benefits as qualifying income - making it a fantastic selection for senior citizens or professionals.

If you've discovered on your own knee-deep in credit history card debt and also have an OK to reasonable credit report, consolidating your debt by means of a personal loan is worthwhile of some severe factor to consider. Interested? If so, understand that Cash money, U. financing bad credit.S.A. processes finance applications of, making them a good candidate for the work.

Top Guidelines Of Financing Bad Credit

$10,000 $500 5. 99% - 35. 99% (differs by lending institution and credit history) Poor credit rating financings approximately $10,000 Credit history cards readily available No minimum credit history demand No minimum month-to-month revenue need High approval score Automobile, house, and also student fundings offered Rate of interest prices can be high on some lendings Not available in all states As the name implies, focuses on giving inadequate credit history debtors with rapid accessibility to money when they need it most.

One crucial attribute that divides the outfit from other financing networks is its inclusion of peer-2-peer lenders. Peer-2-peer financings are different from normal installation finances because they're provided by people, as well as not loan provider. As a result of this, passion prices on peer-2-peer fundings typically include lower interest rates and greater acceptance rates.

The Buzz on Financing Bad Credit

This suggests all finances need to be repaid in one installation and not equivalent monthly payments. That claimed, payday advance featured a lot higher rate of interest than installment fundings as well as range from 235% to 1304%. While this is no question a downside, they come to all loan providers no matter their credit history.

Some lenders also offer term lengths of as much as 72 months, which depending on the rate of interest, can leave you with budget friendly monthly settlements. Of program, just candidates with a suitable credit report will certainly receive the. Still, 247Credit, Currently will certainly refine, which are accessible to applicants with credit rating ratings as reduced as 580.

Things about Financing Bad Credit

If you remain in a pinch, you do not wish to wait approximately 5 business days for a feedback. As a result of this, all offering networks included in our list can have a funding authorized and processed in as little as 24 hours! Bad credit rating installment fundings will always feature greater than ordinary rate of More Help interest - it's inescapable.

Everyone's scenario is various. While some need just a few hundred bucks, others might need accessibility to numerous thousand. With this in mind, our listing of financing networks includes alternatives for lendings as low as $100 and as high as $35,000. Yes, all installment funding lenders will certainly run a credit scores check prior to accepting a finance.

The only lending institutions that do not run credit score checks are payday lenders. Nonetheless, payday advance come with high rates of interest, and because of this, are dramatically much more pricey. A number of respectable financing marketplaces - like Money, Common and Take, Fast3k - can set up negative credit visit our website scores installation lendings in as low as 1 day.

Not known Incorrect Statements About Financing Bad Credit

Comparative, open-ended credit score items - like charge card or credit lines - enable the debtor to utilize as much, or as little, of their prolonged credit report as they like. Open-ended lending important link products have actually no specified repayment duration, and also instead, the borrower has to make a minimum of the minimal monthly settlement to maintain the account in good standing.

Comments on “The Buzz on Financing Bad Credit”